Anyone with financial dependents should buy a Term Insurance Policy. This includes married couples, parents, business people and self-employed, SIP investors, young professionals with dependent parents, and in some cases, even retirees.

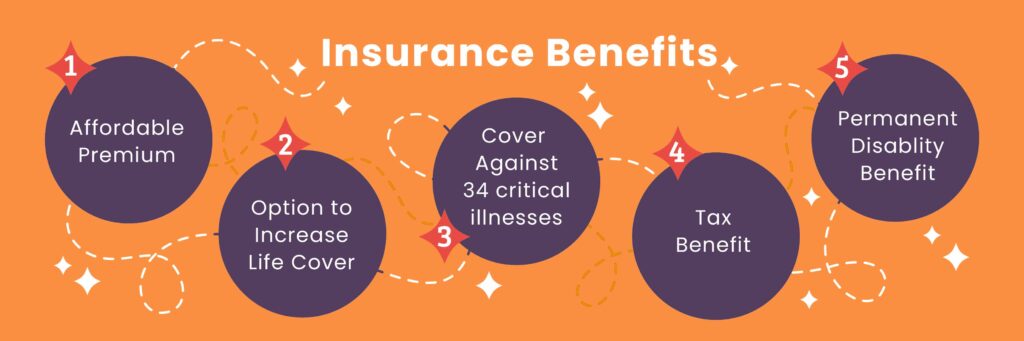

Life insurance premiums paid are deductible from taxable income under Section 80C^^ and hence carry a double benefit for taxpayers – protection and tax-saving. The amount (maturity value) received under a term insurance policy is also tax-exempt subject to conditions under Section 10(10D)^^ of the Income Tax Act, 1961^^. Term Insurance also has among the lowest premiums compared to the different types of insurance policies.

Hence, individuals who derive any of the three significant benefits associated with term insurance should consider buying such policies. The three significant benefits are – life protection, tax-saving and affordable premiums.